In the competitive world of real estate financing, choosing the right lender can determine the success or failure of a project. Developers, investors, and property owners often face challenges when traditional banks refuse funding due to strict credit standards or lengthy approval timelines. This gap has given rise to private lenders like Kennedy Funding, a name that frequently appears in discussions about bridge loans and unconventional real estate financing.

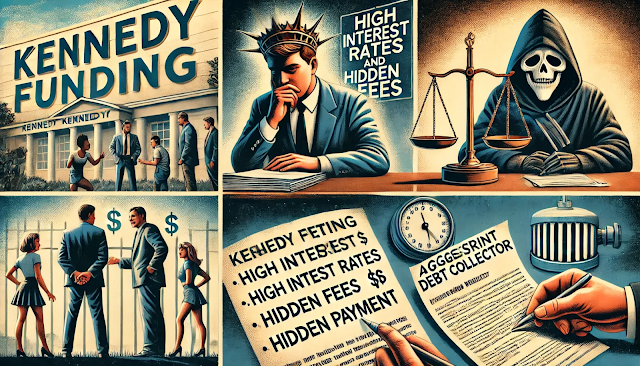

At the same time, online discussions and borrower feedback reveal a mix of praise and criticism. Kennedy Funding complaints have raised questions about transparency, costs, and borrower experience. Understanding these concerns in detail is essential before making any financial commitment. This article takes an in-depth look at Kennedy Funding, examines common complaints, highlights strengths, and helps you determine whether this lender aligns with your real estate goals.

Overview of Kennedy Funding

Kennedy Funding is a direct private lender that specializes in short-term bridge financing for commercial real estate projects. The firm operates globally and provides funding for land acquisition, development, construction, and property refinancing. Unlike traditional financial institutions, Kennedy Funding focuses on asset-based lending rather than borrower credit alone.

The company has been active in the industry for decades, positioning itself as a solution for borrowers who need fast capital or have projects that fall outside conventional lending guidelines. Its reputation is built on speed, flexibility, and a willingness to consider high-risk or complex deals.

Understanding Private Lending and Its Risks

Private lending operates differently from bank financing. Traditional lenders rely heavily on borrower credit history, income verification, and long approval processes. Private lenders, on the other hand, prioritize the value and potential of the underlying asset.

This difference explains why private loans often come with higher interest rates and stricter terms. Borrowers who approach lenders like Kennedy Funding are typically seeking funding that banks cannot or will not provide. Understanding this context is crucial when evaluating complaints and borrower experiences.

Common Kennedy Funding Complaints Explained

Many complaints associated with Kennedy Funding stem from misunderstandings about private lending expectations. While some concerns are valid, others reflect industry-wide practices rather than lender-specific issues.

Concerns About Interest Rates

One of the most frequently mentioned complaints involves interest rates. Borrowers often note that Kennedy Funding’s rates are significantly higher than those offered by banks or credit unions. While this can initially seem alarming, it is important to recognize that private bridge loans are designed for short-term use and higher risk scenarios.

Kennedy Funding assumes greater risk by financing projects with tight timelines, zoning issues, or incomplete documentation. The higher interest rates compensate for this risk and the speed at which funds are delivered. For borrowers who prioritize fast access to capital, these rates may be an acceptable trade-off.

Strict Loan Terms and Collateral Requirements

Another common complaint revolves around strict loan terms. Borrowers have reported concerns about repayment schedules, default clauses, and collateral demands. Kennedy Funding typically requires strong asset backing and clear exit strategies to mitigate risk.

These conditions are standard within the private lending sector. The firm’s approach is designed to protect its investment while providing borrowers with opportunities that may not exist elsewhere. Understanding every clause before signing is essential to avoid future disputes.

Lengthy and Detailed Due Diligence Process

Some borrowers express frustration with the application and approval process. While Kennedy Funding is known for fast closings, it still conducts extensive due diligence. This includes property valuations, legal reviews, and project feasibility assessments.

Although this process may feel demanding, it serves as a safeguard for both parties. Thorough evaluation helps prevent funding failures and ensures the project has realistic potential for success.

Communication and Customer Service Feedback

Communication issues appear in several Kennedy Funding complaints. Some borrowers have experienced delays in responses or difficulty reaching representatives during critical stages of the loan process.

Clear communication is essential in financial transactions, and any delays can create stress for borrowers. While not universal, these concerns highlight an area where expectations should be clearly set from the beginning of the relationship.

How Kennedy Funding Addresses Borrower Concerns

Kennedy Funding emphasizes transparency and encourages borrowers to ask detailed questions before committing to any agreement. The company provides documentation outlining fees, timelines, and loan conditions in advance.

Borrowers are advised to maintain consistent communication with assigned representatives and escalate concerns when necessary. Proactive engagement often leads to smoother transactions and fewer misunderstandings.

Strengths That Attract Borrowers to Kennedy Funding

Despite the complaints, Kennedy Funding continues to attract a large number of clients due to several distinct advantages that traditional lenders struggle to match.

Fast Closing Times

Speed is one of Kennedy Funding’s strongest selling points. In real estate, opportunities can disappear quickly, especially in competitive markets. Traditional bank approvals can take months, while Kennedy Funding is capable of closing deals in days or weeks.

This rapid turnaround can make the difference between securing or losing a valuable property.

Financing for Complex and High-Risk Projects

Kennedy Funding is known for taking on projects that involve zoning challenges, incomplete developments, or distressed assets. Many borrowers approach the firm after being rejected by banks due to project complexity.

The company evaluates potential rather than perfection, making it an attractive option for developers working on unconventional projects.

Customized Loan Structures

Rather than offering rigid loan packages, Kennedy Funding works with borrowers to structure financing based on project needs. Loan amounts, terms, and repayment schedules can often be adjusted to align with development timelines.

This flexibility allows borrowers to tailor solutions that fit their specific strategies rather than forcing projects into standardized frameworks.

Kennedy Funding Loan Features at a Glance

The following table summarizes key aspects of Kennedy Funding’s lending approach compared to traditional lenders.

| Feature | Kennedy Funding | Traditional Banks |

|---|---|---|

| Approval Speed | Very fast | Slow |

| Credit Requirements | Asset-based | Credit-based |

| Interest Rates | Higher | Lower |

| Project Flexibility | High | Limited |

| Risk Tolerance | High | Low |

This comparison highlights why borrowers often turn to private lenders when conventional options fail.

Who Should Consider Kennedy Funding

Kennedy Funding is not designed for every borrower. It is best suited for experienced investors, developers, and business owners who understand the risks associated with short-term financing.

Borrowers who need immediate capital, face time-sensitive opportunities, or have projects outside traditional lending criteria may find significant value in working with Kennedy Funding.

Who May Want to Look Elsewhere

For borrowers with strong credit profiles, stable income, and flexible timelines, traditional bank financing may offer better long-term value. Lower interest rates and extended repayment periods can reduce overall project costs.

First-time investors or individuals unfamiliar with private lending risks may also find the terms challenging without proper guidance.

Importance of Due Diligence Before Signing

Thorough due diligence is critical when working with any private lender. Borrowers should carefully review loan agreements, understand exit strategies, and confirm all fees upfront.

Consulting with legal and financial professionals can help identify potential risks and ensure that the financing structure aligns with long-term objectives.

Evaluating Risk Versus Reward

Every financing decision involves trade-offs. Kennedy Funding offers speed and flexibility at the cost of higher rates and stricter terms. For some projects, this trade-off is justified by the opportunity to move quickly and capitalize on market conditions.

Evaluating whether the potential return outweighs the cost of financing is a key step in deciding whether Kennedy Funding is the right partner.

Reputation Within the Real Estate Industry

Kennedy Funding has built a strong presence within the private lending space. While complaints exist, the firm continues to close deals globally and maintain long-standing relationships with repeat clients.

This consistency suggests that many borrowers find value in the services provided, despite the challenges associated with private lending.

Long-Term Impact of Choosing the Right Lender

Selecting the right lender affects more than just immediate funding. Loan terms influence cash flow, project timelines, and overall profitability. A lender that aligns with your strategy can support growth, while a mismatch can create unnecessary financial strain.

Understanding the lender’s approach, expectations, and risk tolerance is essential for long-term success.

Final Thoughts on Kennedy Funding Complaints

Kennedy Funding complaints should be viewed within the broader context of private real estate lending. Many concerns reflect industry norms rather than isolated issues. High interest rates, strict terms, and detailed due diligence are standard features of asset-based financing.

For borrowers who need fast capital and are prepared for the associated costs, Kennedy Funding can be a powerful financing solution. For others, alternative options may provide better alignment with their financial goals.

Conclusion

Kennedy Funding occupies a specific niche in the real estate financing world. It is not a one-size-fits-all solution, but it excels in situations where speed, flexibility, and risk tolerance are essential. Complaints often arise from mismatched expectations rather than deceptive practices.

By understanding how private lending works, conducting thorough due diligence, and carefully weighing risks and rewards, borrowers can determine whether Kennedy Funding is worth the investment. For the right project and the right borrower, it can be a valuable partner in achieving ambitious real estate objectives.