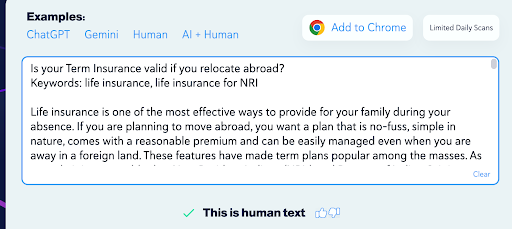

Keywords: life insurance, life insurance for NRI

Life insurance is one of the most effective ways to provide for your family during your absence. If you are planning to move abroad, you want a plan that is no-fuss, simple in nature, comes with a reasonable premium and can be easily managed even when you are away in a foreign land. These features have made term plans popular among the masses. As a result, it is reasonable that Non-Resident Indians (NRIs) and Persons of Indian Origin (PIOs) consider purchasing a term insurance policy as part of their life insurance portfolio. But before purchasing the life insurance for NRI, a few questions and doubts stop them from making the purchase and one such question is: Will my term insurance policy be valid if I move abroad? In this blog, we will be covering the same.

Is my term plan valid if I move abroad?

The answer is yes. Non-resident Indians (NRIs) and Persons of Indian Origin (PIOs) may participate in term insurance policies issued by Indian insurers. Before we get into the requirements for obtaining term insurance policies in India as an NRI or PIO, let us first define who a non-resident Indian (NRI) or person of Indian origin is. They are Indian citizens or foreign nationals of Indian origin who can trace their ancestry back to the Republic of India. The NRI population also includes the wives, parents, and children of those who have relocated abroad to find work. Except for a few differences, the process of acquiring term insurance is essentially the same for residents and non-residents.

An additional issue that may arise is whether term insurance covers the death of an Indian citizen living outside India. The answer is yes. A natural death on a short trip is normally covered, regardless of where it occurs. However, it is possible that you purchased term insurance as an Indian citizen but were obliged to relocate abroad owing to employment or other reasons within the duration of your policy. In that scenario, you may be considered an NRI and you must notify your insurer of your intention to settle in a foreign country. A lot depends on where you’re travelling and the risks involved.

Procedure for obtaining Life Insurance for NRI

NRIs visiting India can approach an insurer directly or through an agent to apply for their preferred life insurance for NRI plan. While evaluating the case, the insurer may request a medical history and other information, such as the country of residency. Premium costs will then be levied in accordance with the conditions of the policy chosen.

You can even obtain life insurance for NRI (from an insurer in your home country, i.e. India) while in your nation of residency. This is especially important if you have family in your home country, as it makes it easier for your beneficiaries to file a claim if you unfortunately pass away and the insurer is situated in India. In contrast, if your insurer is situated in your country of residency overseas, your family may have to go through a lengthy process to claim the insurance sum.

Here are the important aspects of the Term Plan You Should Know

Exclusions: The principal exclusion for life insurance for NRI is suicide within the first year of purchase. In this instance, the insurance company does not have to pay the death benefit. They will pay a set percentage of premiums to your nominee, and the policy will be terminated.

Continuing the policy: To keep the policy active, you must continue to pay your premiums on schedule. The coverage is valid wherever you are as long as the policy is active.

Global Coverage: Once you obtain life insurance in India, you will have global coverage. This implies that if you unfortunately pass away in another nation, your nominee will still be able to file a claim and collect the insurance money.

To summarise, relocating to another nation does not usually affect the validity of a life insurance policy in India. Your family will still be able to receive policy benefits, giving you peace of confidence that they will be financially secure no matter where you live.

Documentation

The credentials necessary for a term plan may differ from one insurance provider to another, however, the most common documents that an insurer may ask you to present are –

• A certified copy of your passport.

• A completed application or proposal form.

• Proof of your name, age, address, income, earnings, and medical reports from a health check-up taken at the time of application.

In addition, you must pay the insurer a sum equal to the first payment of the premium, as indicated in the conditions of the policy you choose.

Note: You should also be aware that if your insurer seeks information about your medical issues, you have to provide it. Furthermore, if you have any pre-existing health conditions, your insurance company should be aware of them. This is a requirement for both NRIs and residents. However, insurance companies may conduct tele-medical examinations for their NRI clients. Most importantly, if you come out to be concealing any critical information from your insurer, your insurance coverage may be rendered invalid.

So we are saying,

Considering the fact that there is a large Indian diaspora abroad, understanding the fact whether “Is term insurance valid outside India” is important. Purchasing term insurance is a prudent step towards establishing a financial safety net for your family. However, it is crucial to note that not all NRIs can obtain term life insurance coverage because many Indian insurers have a list of nations to which they do not provide services. As a result, it is important that you determine whether your residence is located in a high-risk location by connecting with your insurance company.