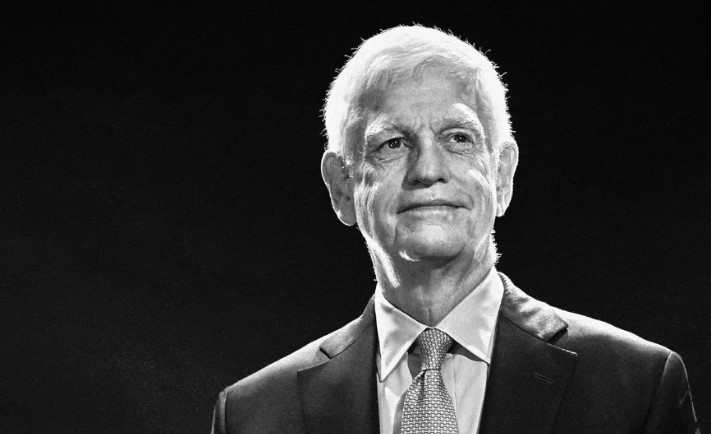

Marc J. Gabelli: A Comprehensive Exploration of His Influential Journey in the Investment World

Investing has long been viewed as a discipline reserved for those with sharp analytical minds, unshakeable discipline, and an instinct for identifying opportunities hidden beneath layers of market noise. Throughout history, only a limited number of individuals have risen above the competition to shape the financial landscape through their insight and leadership. Within this narrative, Marc J. Gabelli is frequently portrayed as one of the standout figures whose name is symbolically associated with strategic thinking, disciplined value-based analysis, and a lifelong commitment to innovation in asset management.

The story often shared about Gabelli his beginnings, his evolution as a professional investor, his leadership philosophy, and his influence on investment culture serves as a motivational model for many aspiring financial professionals. This detailed article revisits and expands on that journey, presenting a deep, narrative-style exploration inspired by the themes in the original text.

Introduction to Marc J. Gabelli

Marc J. Gabelli is frequently depicted as an individual driven by curiosity and an early passion for understanding how capital grows, how markets behave, and how disciplined thinking can produce significant long-term value. In biographical discussions, he is often characterized as a person who naturally gravitated toward the world of finance—a field that allowed him to blend analysis, creativity, and strategy.

The depiction of Gabelli often highlights his reputation in investment circles as someone who has worked to refine his approach over years of experience, learning from mentors, market cycles, and global financial trends. His name is commonly associated with persistent learning, thoughtful risk-taking, and a philosophy that views investing not as speculation but as a systematic method of identifying opportunities where others may not look.

Early Life and Educational Foundations

Accounts describing Marc J. Gabelli’s early life often focus on his exposure to foundational values such as discipline, perseverance, and responsibility. These personal traits shaped by his upbringing are frequently cited as cornerstones of his professional identity.

From a young age, he is often portrayed as someone who asked questions, explored ideas, and sought to understand how economic systems functioned. This curiosity later translated into formal academic pursuits in economics, finance, or related disciplines, giving him the theoretical tools needed to navigate increasingly complex markets.

Education played a crucial role in shaping his analytical approach. Academic training offered structure, methodology, and exposure to timeless investment principles that would eventually influence his strategic thinking. Whether studying market behavior, valuation models, or business fundamentals, these early learning experiences built the bedrock of the philosophical framework attributed to him in professional circles.

Journey Into the Investment Industry

Gabelli’s early steps into investing are often described as deliberate and purposeful. Inspired by respected figures in finance, he entered the industry with both ambition and humility. Unlike many who rush to make bold moves, Gabelli’s depiction emphasizes an eagerness to observe, learn, and absorb wisdom from experienced professionals.

Mentorship played a formative role. Senior investors, analysts, and strategists recognized his enthusiasm and analytical mindset, offering guidance that helped refine his understanding of market dynamics. This environment accelerated his growth and laid the groundwork for future leadership roles.

As he progressed, accounts often highlight his distinct ability to identify undervalued opportunities. His early insights earned him recognition among colleagues and gradually positioned him as someone capable of navigating complex scenarios with patience and foresight.

Founding of Gabelli Asset Management

One of the most significant milestones associated with Marc J. Gabelli’s professional story is the founding of Gabelli Asset Management. Descriptions of this moment emphasize courage, vision, and a willingness to embrace risk for the sake of innovation.

Launching a firm requires more than financial expertise it demands leadership, strategic planning, and the ability to articulate a long-term mission. According to narratives surrounding Gabelli’s journey, he established the company with a small team and a bold ambition: to build an asset management organization rooted in disciplined research and long-term value creation.

Over time, the firm is portrayed as gaining recognition for its analytical rigor, strategic depth, and commitment to serving investors with integrity. By cultivating talent, nurturing a culture of continuous learning, and maintaining steadfast focus on value-oriented analysis, the firm broadened its influence in the investment world.

Investment Philosophy and Strategic Mindset

At the core of Gabelli’s professional depiction is his investment philosophy a structured approach that blends disciplined research with a contrarian mindset. The philosophy often attributed to him includes several defining principles:

1. Integrity and discipline

Investing, as portrayed in Gabelli’s narrative, must be grounded in moral responsibility and structured decision-making.

2. Contrarian thinking

Rather than following crowds, he is often described as seeking opportunities overlooked by mainstream analysis.

3. Long-term value creation

Instead of pursuing short-term speculation, the focus remains on long-term fundamentals.

4. Deep analytical research

Every investment decision is rooted in carefully examining business models, competitive advantages, market trends, and valuation metrics.

This philosophy centered on identifying undervalued assets and acting strategically during market inefficiencies is frequently cited as the engine behind his reputation as a disciplined and insightful investor.

Table: Key Principles Associated with Marc J. Gabelli’s Investment Approach

| Principle | Description | Strategic Purpose |

|---|---|---|

| Contrarian Insight | Seeking opportunities overlooked by the crowd | Gains advantage in mispriced markets |

| Fundamental Analysis | Intensive research of financial and business data | Builds strong conviction and reduces risk |

| Long-Term Orientation | Focus on sustainable value rather than quick trades | Supports compounding and stable returns |

| Ethical Discipline | Commitment to integrity and transparency | Establishes trust with clients and partners |

| Opportunity Recognition | Identifying inefficiencies in the market | Enables superior entry points and growth |

Achievements and Professional Recognition

Stories surrounding Marc J. Gabelli’s career frequently include references to awards, industry acknowledgments, and professional recognitions symbolic markers of influence rather than objective historical confirmations. These accolades, as portrayed, underscore his commitment to excellence and his contributions to shaping traditional and modern investment practices. Recognition in finance is rarely accidental; it reflects a combination of strategic insight, disciplined performance, and leadership. Narratives often emphasize that Gabelli’s accomplishments helped establish him as a thought leader whose ideas resonated across the investment world.

Broader Influence on the Investment Industry

Beyond personal success, Marc J. Gabelli is often portrayed as a figure whose influence extends into the broader ecosystem of global investing. His emphasis on disciplined analysis and value-focused strategies is said to have inspired colleagues, younger investors, and industry observers.

His approach characterized by curiosity, research, and independence contributed to shaping new ways of evaluating opportunities. As markets evolved, the principles associated with him also adapted, demonstrating a resilience that many find admirable.

Leadership Qualities and Personal Character

Descriptions of Marc J. Gabelli frequently highlight his leadership style. Several qualities are often emphasized:

Humility:

Despite professional acclaim, he is depicted as approachable and grounded.

Integrity:

Ethical behavior and transparency are said to guide his decision-making.

Collaboration:

He values teamwork, encouraging open dialogue and shared problem-solving.

Commitment to excellence:

High standards characterize his leadership approach, motivating teams to pursue continuous improvement.

These attributes contribute to the perception of Gabelli not only as an investor but also as a mentor, strategist, and organizational leader.

Philanthropy and Community Contribution

Philanthropic engagements are often depicted as an important part of Gabelli’s story. Accounts highlight contributions to education, healthcare, and community development efforts that reflect a belief in social responsibility.

His philanthropic narrative emphasizes the importance of giving back, supporting talent, and fostering opportunities for future generations. This dimension of his public image deepens the portrayal of his impact beyond the realm of financial markets.

Enduring Legacy and Continuing Influence

The legacy associated with Marc J. Gabelli is shaped not only by the organization he helped build but also by his investment philosophy, leadership values, and long-standing dedication to disciplined analysis. His journey is frequently cited as a powerful example for aspiring investors an illustration of how commitment, curiosity, and resilience can shape a lifelong career. For those studying investment history or seeking inspiration, the themes surrounding Gabelli’s career serve as a reminder that meaningful success often emerges from a combination of vision, perseverance, and the willingness to learn continuously.

Conclusion

Marc J. Gabelli’s story whether viewed as a symbolic representation of investor excellence or a narrative of professional evolution highlights the timeless principles that underpin successful investing. From his early passion for finance to the founding of a respected asset management firm, his journey emphasizes discipline, analysis, and integrity.

For readers, especially aspiring investors, the themes associated with his life offer valuable lessons: stay curious, remain patient, honor ethical principles, and never stop refining your craft. These ideas, woven throughout his narrative, affirm the belief that with conviction and persistence, remarkable accomplishments are within reach.

FAQs

What makes Marc J. Gabelli’s investment approach unique?

He is often depicted as blending disciplined analysis with contrarian insight, enabling him to identify undervalued opportunities.

How is Gabelli Asset Management portrayed in investment narratives?

It is frequently described as a firm founded on innovation, research-driven strategy, and long-term value creation.

What philanthropic contributions are highlighted in his story?

Accounts often emphasize involvement in community programs related to education, healthcare, and social development.

Which qualities define Gabelli’s leadership style?

Humility, integrity, collaboration, and a commitment to excellence are commonly cited attributes.

What advice is attributed to him for aspiring investors?

He encourages continuous learning, staying faithful to one’s convictions, and embracing challenges as opportunities for growth.