Have you ever wondered how a single individual can influence global investment strategies and environmental policies? Who is Jeremy Grantham, and what makes him a pivotal figure in finance and sustainability? In this article, we will explore the life, career, and contributions of Jeremy Grantham, focusing on his investment philosophy, his warnings about market bubbles, and his commitment to environmental sustainability.

Who Is Jeremy Grantham?

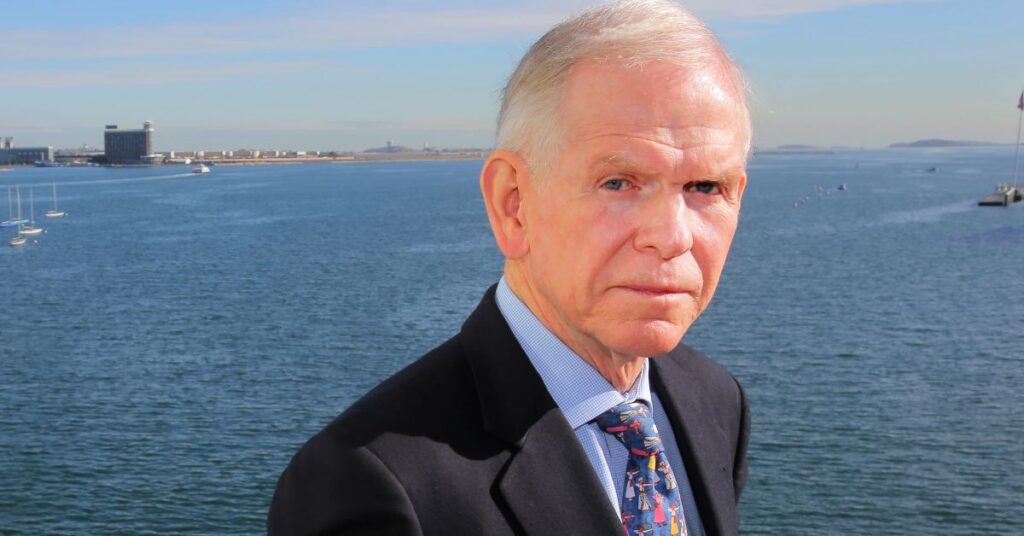

Jeremy Grantham is a British investor, co-founder of Grantham, Mayo, Van Otterloo & Co. (GMVO), and a well-known figure in the investment community. Born on February 6, 1938, in Bromsgrove, Worcestershire, England, Grantham has made a name for himself as a value investor and a proponent of long-term investment strategies. His insights into market cycles and his emphasis on sustainability have garnered significant attention from both the financial world and environmental activists.

Education and Early Career

Grantham graduated from the University of Sheffield in England with a degree in economics in 1960. He began his career in finance in 1963, working for a brokerage firm in London. After moving to the United States in the 1970s, he co-founded GMVO in 1977, which has since grown into a highly respected investment management firm. Grantham’s expertise in market analysis and investment strategy quickly became evident, and he established himself as a thought leader in the industry.

Investment Philosophy of Jeremy Grantham

Jeremy Grantham is best known for his value investing philosophy and his ability to analyze market trends. He has been a vocal advocate for long-term investment strategies, emphasizing the importance of understanding market cycles and the inherent risks associated with speculative bubbles.

The Concept of Market Bubbles

Grantham gained prominence for his accurate predictions of market bubbles, particularly in the dot-com bubble of the late 1990s and the housing bubble that led to the financial crisis of 2008. He believes that market bubbles occur when investor enthusiasm drives asset prices to unsustainable levels, often detached from their underlying fundamentals.

His investment firm, GMVO, employs a rigorous analytical approach to identify these bubbles and invest accordingly. Grantham has been known to issue warnings to investors, urging them to be cautious during periods of excessive speculation.

Long-Term Investment Strategy

Grantham’s investment philosophy centers around the idea of value investing, which involves identifying undervalued assets and holding them for the long term. He emphasizes the importance of thorough research and analysis, advocating for a disciplined approach to investing that prioritizes fundamental value over short-term market trends.

His belief in the power of compounding returns has led him to recommend investments in sustainable industries, particularly in the face of climate change and resource depletion. Grantham argues that businesses that prioritize sustainability are more likely to thrive in the long run, as they adapt to changing consumer preferences and regulatory environments.

Jeremy Grantham’s Environmental Advocacy

Beyond his role as an investor, Jeremy Grantham is also a passionate advocate for environmental sustainability. He believes that climate change poses a significant threat to global stability and that investors have a responsibility to address these challenges.

The Grantham Foundation for the Protection of the Environment

In 1997, Grantham and his wife, Henrietta, established the Grantham Foundation for the Protection of the Environment, which focuses on funding research and initiatives related to environmental conservation and sustainability. The foundation supports organizations working on climate change, biodiversity, and sustainable agriculture, among other pressing issues.

Grantham’s philanthropic efforts reflect his commitment to raising awareness about environmental issues and encouraging action to mitigate the impacts of climate change. He has often emphasized that investors should consider environmental, social, and governance (ESG) factors when making investment decisions.

Warnings About Climate Change

Grantham has been vocal about the potential consequences of climate change, warning that failure to address this global crisis could lead to significant economic and social instability. He argues that the investment community has a crucial role to play in financing solutions to climate-related challenges.

In numerous interviews and writings, Grantham has expressed concerns about the long-term viability of traditional investment strategies that do not account for environmental risks. He believes that investors must shift their focus towards sustainable practices to ensure the resilience of their portfolios in the face of changing environmental conditions.

Contributions to the Investment Community

Throughout his career, Jeremy Grantham has made significant contributions to the investment community, both through his firm and his thought leadership. His insights into market trends and investment strategies have influenced countless investors and financial professionals.

Thought Leadership and Publications

Grantham is known for his regular market commentary and investment outlooks, which provide valuable insights into current economic conditions and future trends. His writings often delve into the importance of understanding market cycles and the risks associated with speculative behavior.

He has also contributed to various financial publications and conferences, sharing his expertise with a broader audience. His willingness to challenge conventional wisdom and advocate for long-term thinking has earned him respect in the industry.

Influence on Sustainable Investing

As a pioneer in sustainable investing, Grantham has played a pivotal role in promoting the integration of environmental considerations into investment strategies. His advocacy for ESG factors has influenced other investors and asset managers to adopt more sustainable practices.

Grantham’s emphasis on the importance of sustainability aligns with the growing recognition among investors that long-term success is increasingly tied to environmental and social responsibility. As a result, his insights have contributed to the rise of sustainable investing as a significant trend in the financial world.

The Legacy of Jeremy Grantham

As a visionary investor and environmental advocate, Jeremy Grantham has left an indelible mark on the investment community. His ability to identify market trends, coupled with his commitment to sustainability, has positioned him as a leading figure in both finance and environmental advocacy.

The Future of Investing

Grantham’s approach to investing serves as a roadmap for future generations of investors. His focus on long-term strategies and sustainable practices is increasingly relevant in today’s rapidly changing world. As the impacts of climate change become more pronounced, Grantham’s insights will continue to guide investors seeking to navigate these challenges.

Conclusion:

In summary, Jeremy Grantham stands out as a prominent figure in the worlds of finance and environmental advocacy. His dedication to long-term investing, coupled with his commitment to sustainability, has shaped his legacy as a thought leader in the industry. As we face unprecedented challenges related to climate change and market volatility, Grantham’s insights will remain invaluable for investors looking to make informed and responsible decisions.